The American Express Centurion Card, more commonly known as the “Black Card,” has become the status symbol du jour for high-end cardholders. But how do you get your mitts on one? Here’s a roadmap.

The American Express Centurion Card, more commonly known as the “Black Card,” has become the status symbol du jour for high-end cardholders. But how do you get your mitts on one? Here’s a roadmap.

The high-end credit card has actually been around for about a decade, and shares more myths and legends than the entire story arch of The X-Files. Going back to the 1980s, hip urbanites spoke of a magical credit card where the owners could order up the Concorde for a trip to Paris, or where someone knew someone who used a “black” card to buy the horse Kevin Costner used in the Oscar winning Dances With Wolves. To date, no stories like the ones listed above have ever been confirmed, but that hasn’t stopped some affluent Americans from wondering if they’re missing out by not having the card.

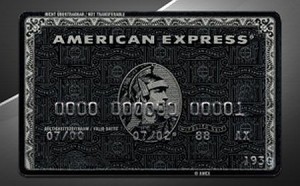

Turn the page to 1999, where myth meets reality and American Express (NYSE: AXP – News) actually does release a black credit card — the Centurion, named after Amex’s corporate logo. According to AdSavvy.org, the Black Card is made of anodized titanium, a heavier substance that gives the card more heft, literally and figuratively. Benefits include automatic first-class upgrades on all airline flights; a personal shopper in major cities worldwide, top-of-the-line concierge and travel agent service, the first crack at elite shows and sporting events, and after-hours privileges at elite stores and boutiques worldwide.

But the marketing gurus at Amex made a conscious choice to build on the Centurion’s “urban legend” status — especially the part about how getting one is as difficult as getting George Clooney’s private cell phone number. That’s why, up until 2006, the Black Card was issued to preferred clients by invitation only.

So how do you go about getting a Black Card? The good news, as it were, is that you no longer have to be invited by Amex to get one. Just call Amex and ask. To heighten your chances, you’ll need to accomplish the following (from the blog QuickSprout.com, whose founder is a Centurion cardholder):

• Have a nearly blemish-free credit history.

• Spend at least $250,000 annually on a current Amex Platinum or Gold card.

• Accept a one-time card membership fee of $5,000, along with an annual fee of $2,500.

• Have a “major” net worth (undisclosed by Amex).

You can call and ask for an invitation at 1-800-263-1616 — but this ploy definitely falls into the “it can’t hurt to ask” category. If you do, be prepared to answer some tough questions.

One hurdle, for example, that would be tough to crack is the $250,000 annual spending minimum. That’s about $21,000 per month and most individuals would balk at spending that kind of dough. QuickSprout advises offering to pay the money upfront, to convince Amex you’re a good credit risk.

If you want to bypass the invitation/application route, you need to be both successful and creative. One possibility for the elite business set is working for a firm that issues Centurion cards to high-end executives. That way you don’t have to hunt down the card — it will find you.

It’s a high mountain to climb but those who are there say it’s worth it. Amex built the Black Card around its signature phrase, “membership has its privileges.” In the case of the Centurion card, boy does it ever.

Article is taken from Yahoo and the link for the original post can be found by clicking here

Thfire.com Everyday news that matters

Thfire.com Everyday news that matters